Payroll tax expense formula

Compare Side-by-Side the Best Payroll Service for Your Business. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

Payroll Journal Entries Financial Statements Balance Sheets Video Lesson Transcript Study Com

Sign Up Today And Join The Team.

. Enter General Information About Paying Your Employees. Payroll Seamlessly Integrates With QuickBooks Online. Free Unbiased Reviews Top Picks.

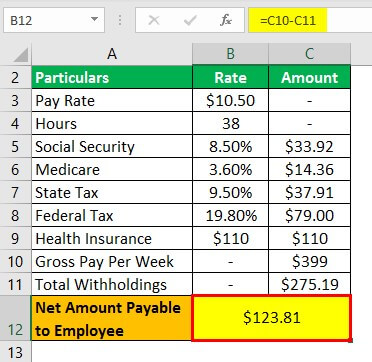

Get Started for Free. Learn About Payroll Tax Systems. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Medicare is 145 of the gross pay. Over 900000 Businesses Utilize Our Fast Easy Payroll. Annual Salary on column C copy this formula on.

Over 900000 Businesses Utilize Our Fast Easy Payroll. 2020 Federal income tax withholding calculation. Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

Ad Compare This Years Top 5 Free Payroll Software. Need formula for budgeting payroll taxes. Payroll Expenses Formula ƒ Sum Payroll Expenses How to calculate Payroll Expenses Assume you have 10 employees who each receive a gross annual pay of 30K post.

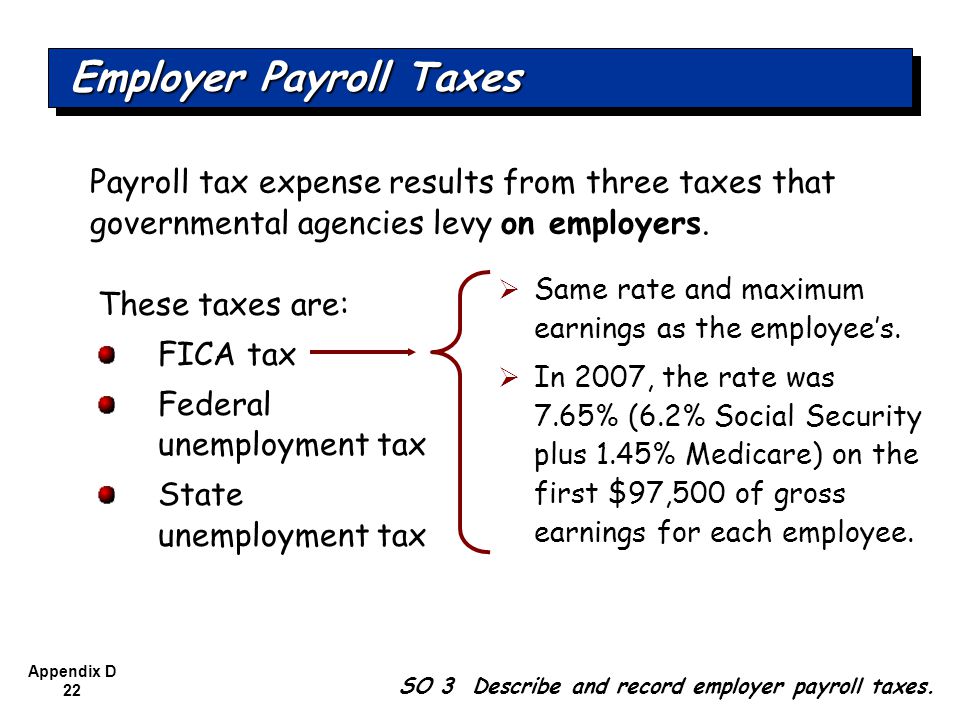

You need to match each employees FICA tax liability. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Sign Up Today And Join The Team.

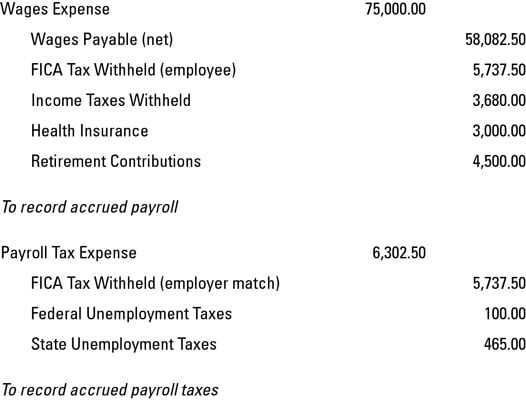

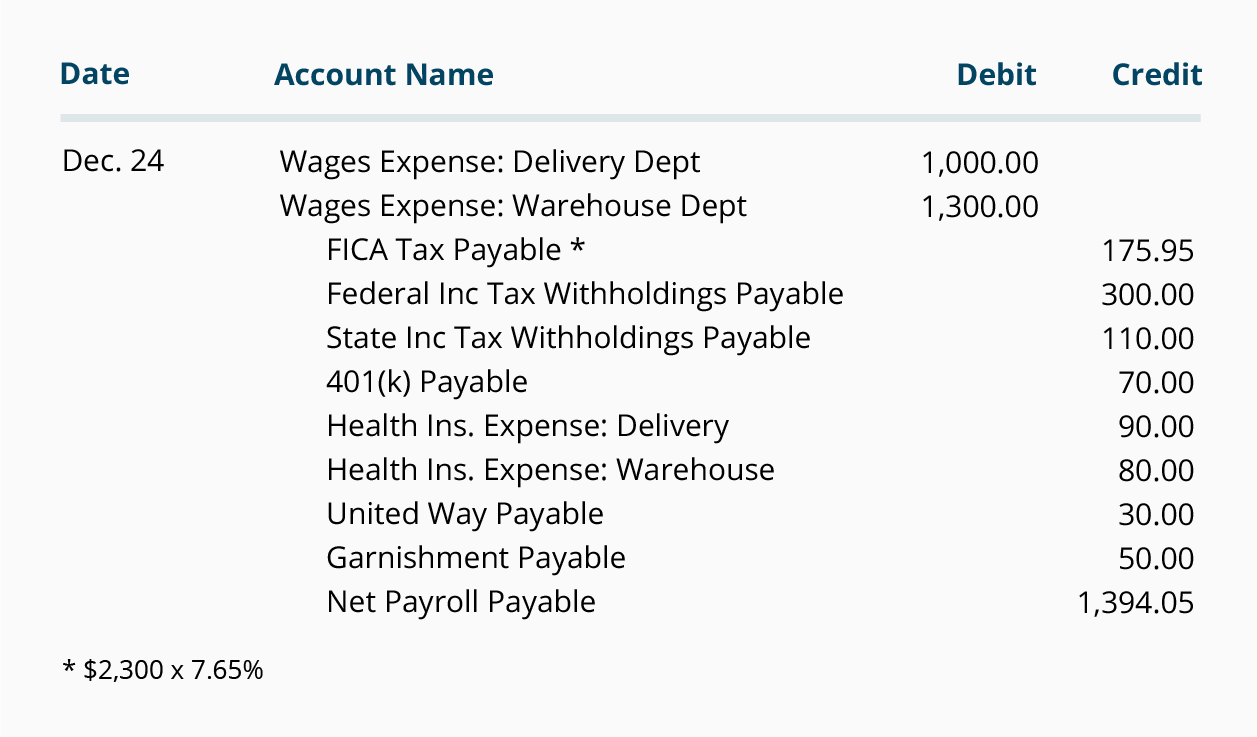

Form 941 is used to report wages withholdings and calculate Social Security and Medicare taxes. Helping Businesses Manage Their Tax Responsibilities Through Remote Tax Tools. Debits and credits are always.

Currently employers pay a 62 Social Security tax and a 145 Medicare tax 765 in total. Ad Find Out How EY Helps Businesses Successfully Overcome Various Tax Challenges. Payroll Expenses Formula ƒ.

Say on your spreadsheet Col A has Name of the employees and column B has. Each worker pays the same 765 tax through payroll withholdings. Payroll tax is a tax that an employer withholds and pays on behalf of his employees.

Multiply the gross pay by 145 or. Now onto calculating payroll taxes for employers. The payroll tax expense amount is the total amount you must pay in taxes the payable liability accounts tell you where the payroll tax expense money goes.

Multiply 062 times total wages to figure Social. Ad Make Your Payroll Effortless and Focus on What really Matters. Multiply 062 times total wages to figure Social Security tax expense.

This is another tax that is paid by both the employee and the employer. Learn About Payroll Tax Systems. Subtract 12900 for Married otherwise.

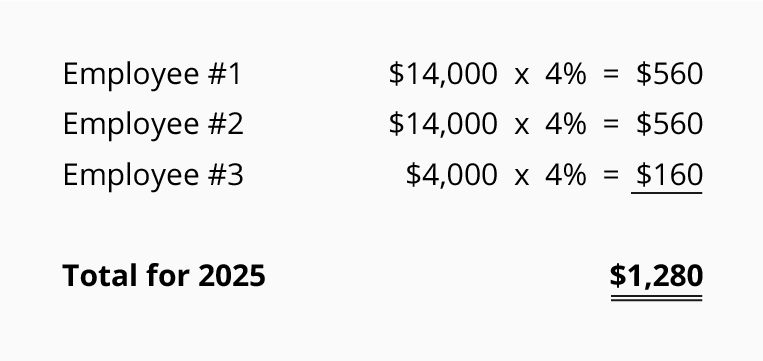

Multiply the number of withholding allowances the employee has claimed on his W4 form by the amount of one allowance for his filing status and the length of the pay period. Employer FICA Tax Liability Total 11475 9180 15300. How do I do payroll in QuickBooks.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. 48000 x 0062 2976 Social Security tax. The payroll tax is based on the wage or salary of the employee.

Payroll Tax What It Is How To Calculate It Bench Accounting

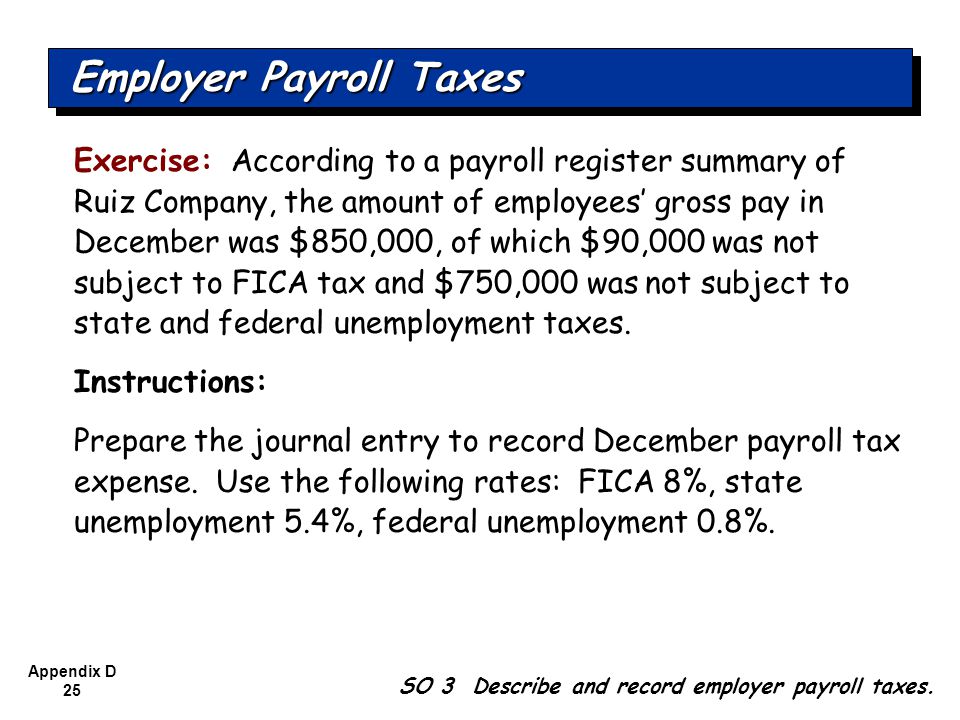

Financial Accounting Sixth Edition Ppt Download

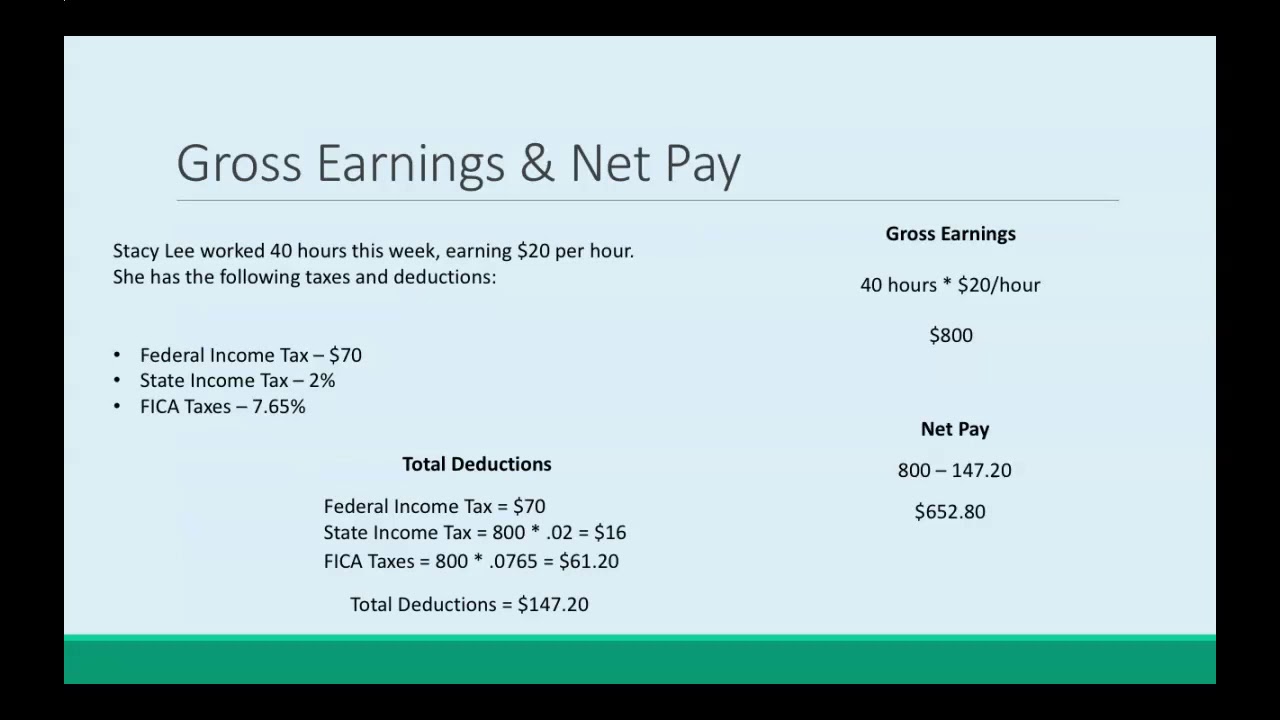

Federal Income Tax Fit Payroll Tax Calculation Youtube

How To Record Accrued Payroll And Taxes Dummies

Payroll Formula Step By Step Calculation With Examples

Payroll Taxes Costs And Benefits Paid By Employers Accountingcoach

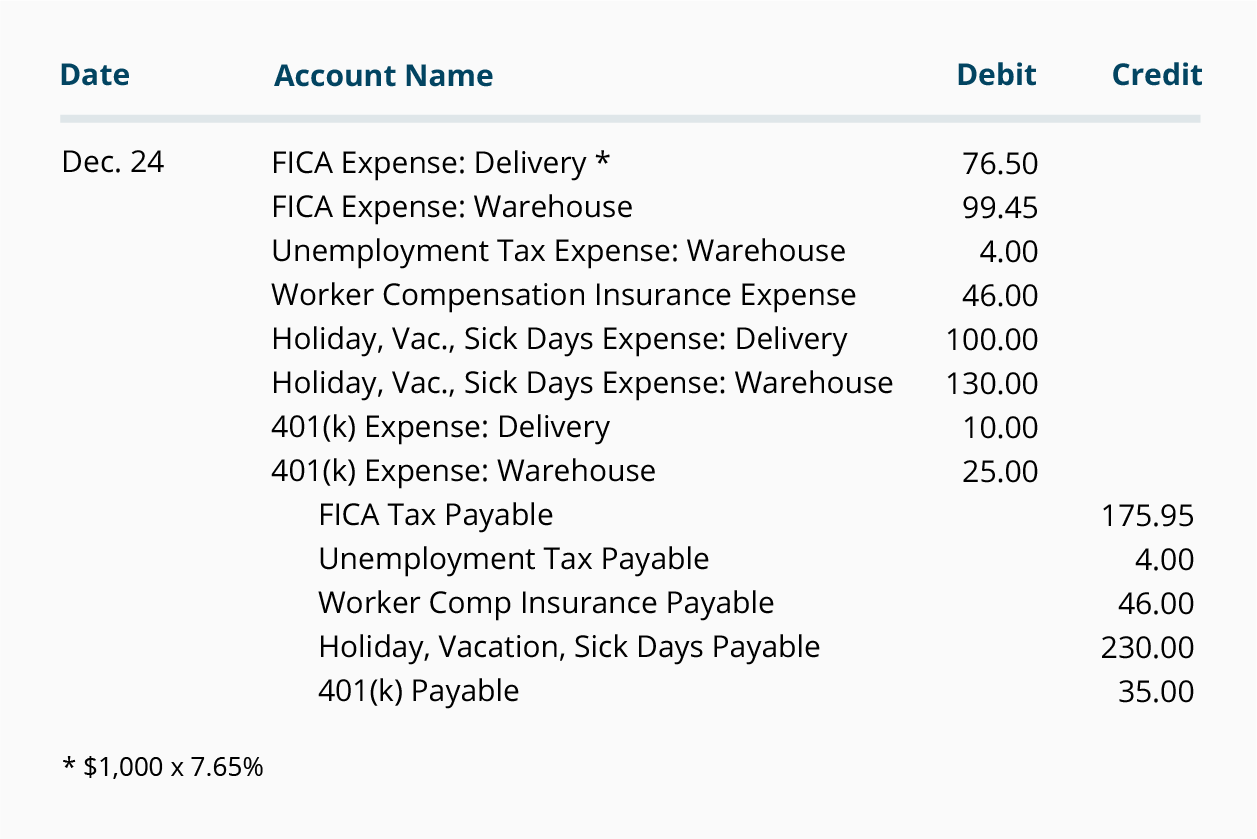

Payroll Journal Entries For Wages Accountingcoach

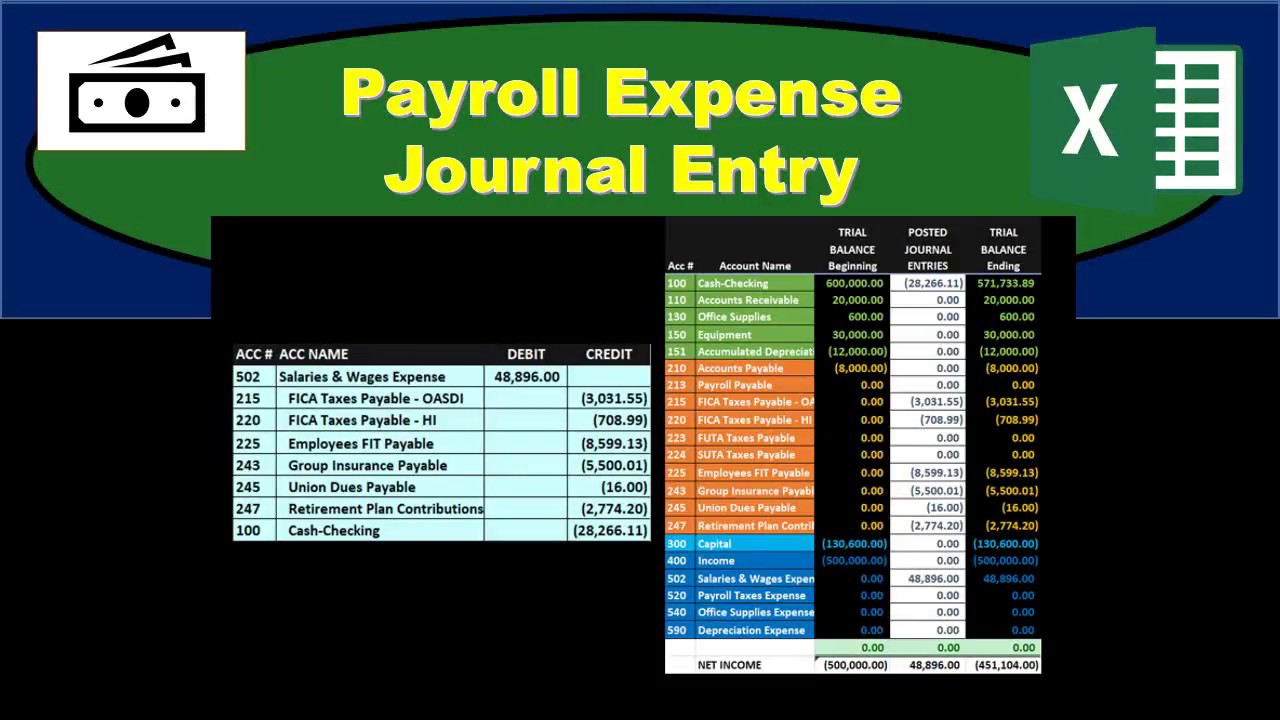

Payroll Journal Entries Financial Statements Balance Sheets Video Lesson Transcript Study Com

Payroll Journal Entries Youtube

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Financial Accounting Sixth Edition Ppt Download

Payroll Expense Journal Entry How To Record Payroll Expense And Withholdings Youtube

Taxable Income Formula Examples How To Calculate Taxable Income

Payroll And Payroll Taxes Accounting In Focus

Payroll Tax Calculator For Employers Gusto

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Journal Entries For Wages Accountingcoach